All Categories

Featured

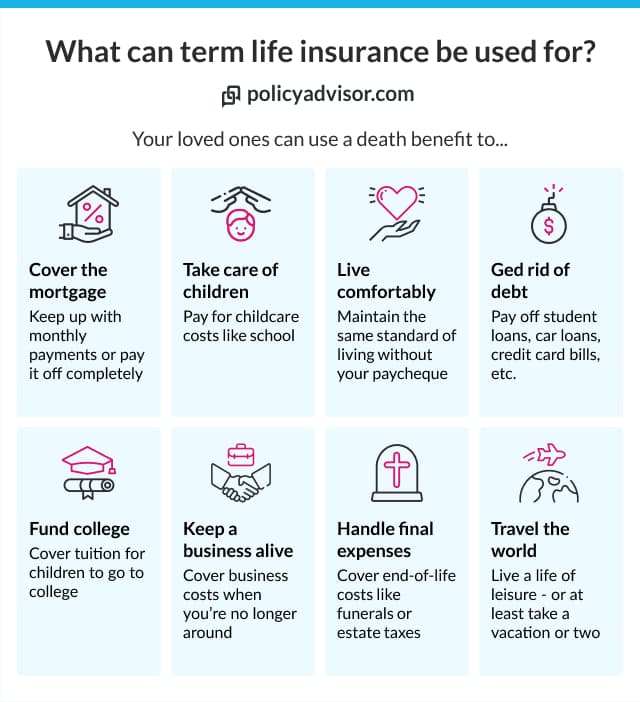

Consider Utilizing the cent formula: DIME stands for Financial debt, Earnings, Mortgage, and Education and learning. Total your financial obligations, home loan, and college expenses, plus your wage for the variety of years your family members needs security (e.g., till the kids are out of the residence), and that's your protection demand. Some monetary specialists determine the amount you need making use of the Human Life Value ideology, which is your lifetime earnings possible what you're earning currently, and what you expect to earn in the future.

One method to do that is to try to find business with strong Economic toughness scores. can you get term life insurance if you have cancer. 8A business that underwrites its own plans: Some business can sell policies from another insurance provider, and this can add an extra layer if you wish to change your plan or in the future when your household requires a payment

Which Of The Following Statements Regarding Term Life Insurance Is Incorrect?

Some companies offer this on a year-to-year basis and while you can anticipate your prices to increase significantly, it may deserve it for your survivors. One more way to compare insurance provider is by taking a look at on-line consumer testimonials. While these aren't most likely to inform you much concerning a business's economic stability, it can tell you exactly how simple they are to collaborate with, and whether insurance claims servicing is an issue.

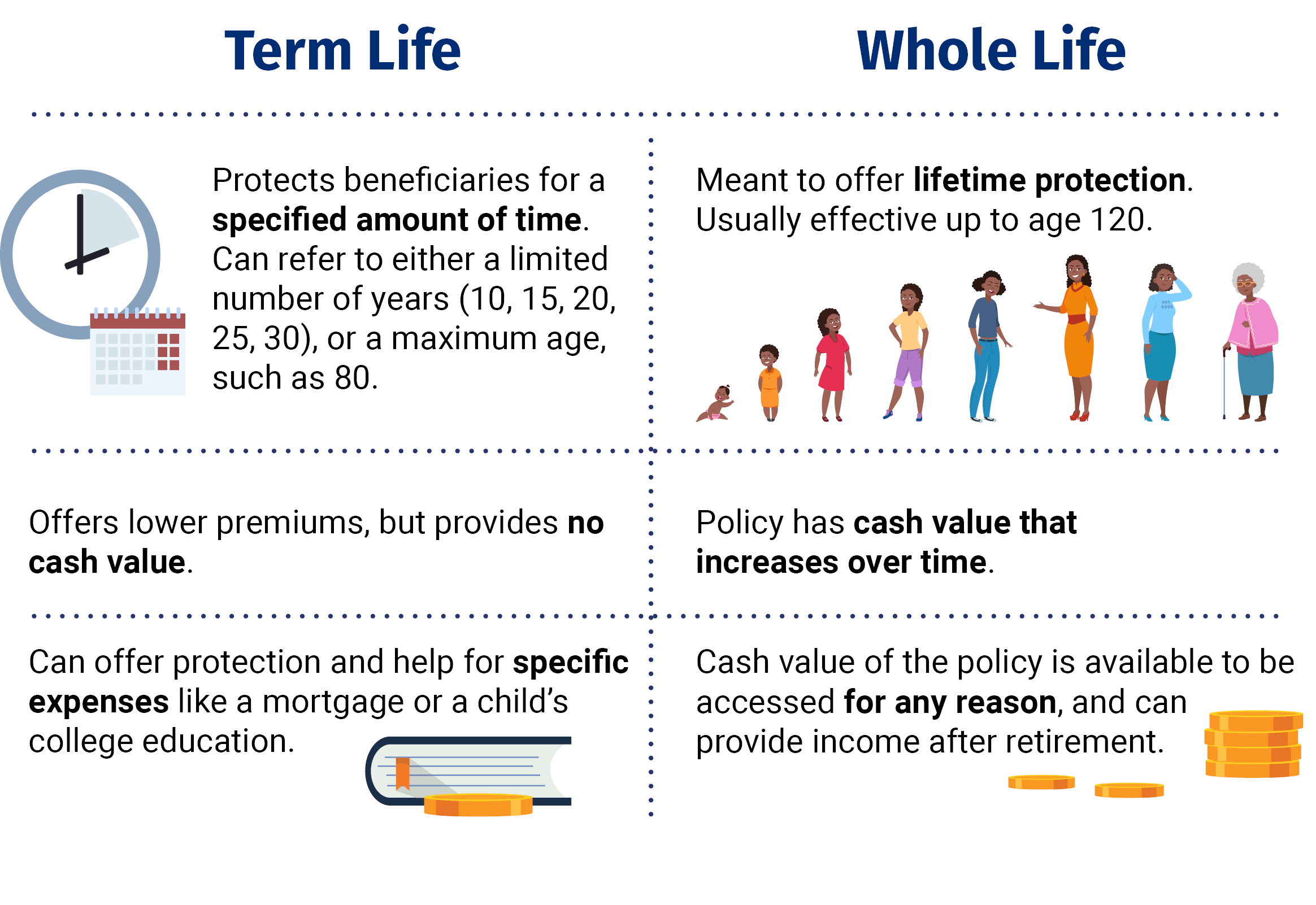

When you're younger, term life insurance can be a straightforward way to protect your loved ones. As life changes your economic priorities can as well, so you might want to have entire life insurance policy for its life time protection and extra benefits that you can use while you're living.

Approval is assured no matter your health and wellness. The costs won't enhance once they're established, yet they will certainly go up with age, so it's an excellent idea to secure them in early. Learn more concerning how a term conversion works.

1Term life insurance policy uses short-term protection for a vital duration of time and is typically much less expensive than permanent life insurance policy. what does the term illustration mean when used in the phrase life insurance policy illustration. 2Term conversion standards and limitations, such as timing, might use; as an example, there may be a ten-year conversion benefit for some products and a five-year conversion opportunity for others

3Rider Insured's Paid-Up Insurance policy Purchase Choice in New York. There is an expense to exercise this cyclist. Not all participating plan proprietors are eligible for rewards.

Latest Posts

A Long Term Care Rider In A Life Insurance Policy

The Best Funeral Plan

Online Funeral Insurance