All Categories

Featured

Consider Utilizing the dollar formula: cent represents Financial obligation, Income, Home Loan, and Education and learning. Overall your debts, home mortgage, and college costs, plus your income for the number of years your family needs security (e.g., till the youngsters are out of the home), which's your protection requirement. Some economic professionals determine the amount you need using the Human Life Value viewpoint, which is your lifetime revenue possible what you're earning now, and what you anticipate to earn in the future.

One way to do that is to search for business with solid Financial stamina rankings. ing term life insurance quote. 8A firm that underwrites its own plans: Some companies can sell policies from one more insurance company, and this can include an added layer if you wish to alter your plan or down the roadway when your family needs a payment

Can You Increase Term Life Insurance Coverage

Some firms use this on a year-to-year basis and while you can anticipate your prices to climb considerably, it might be worth it for your survivors. Another method to contrast insurer is by looking at on the internet customer evaluations. While these aren't most likely to tell you much about a firm's financial stability, it can inform you how easy they are to deal with, and whether insurance claims servicing is an issue.

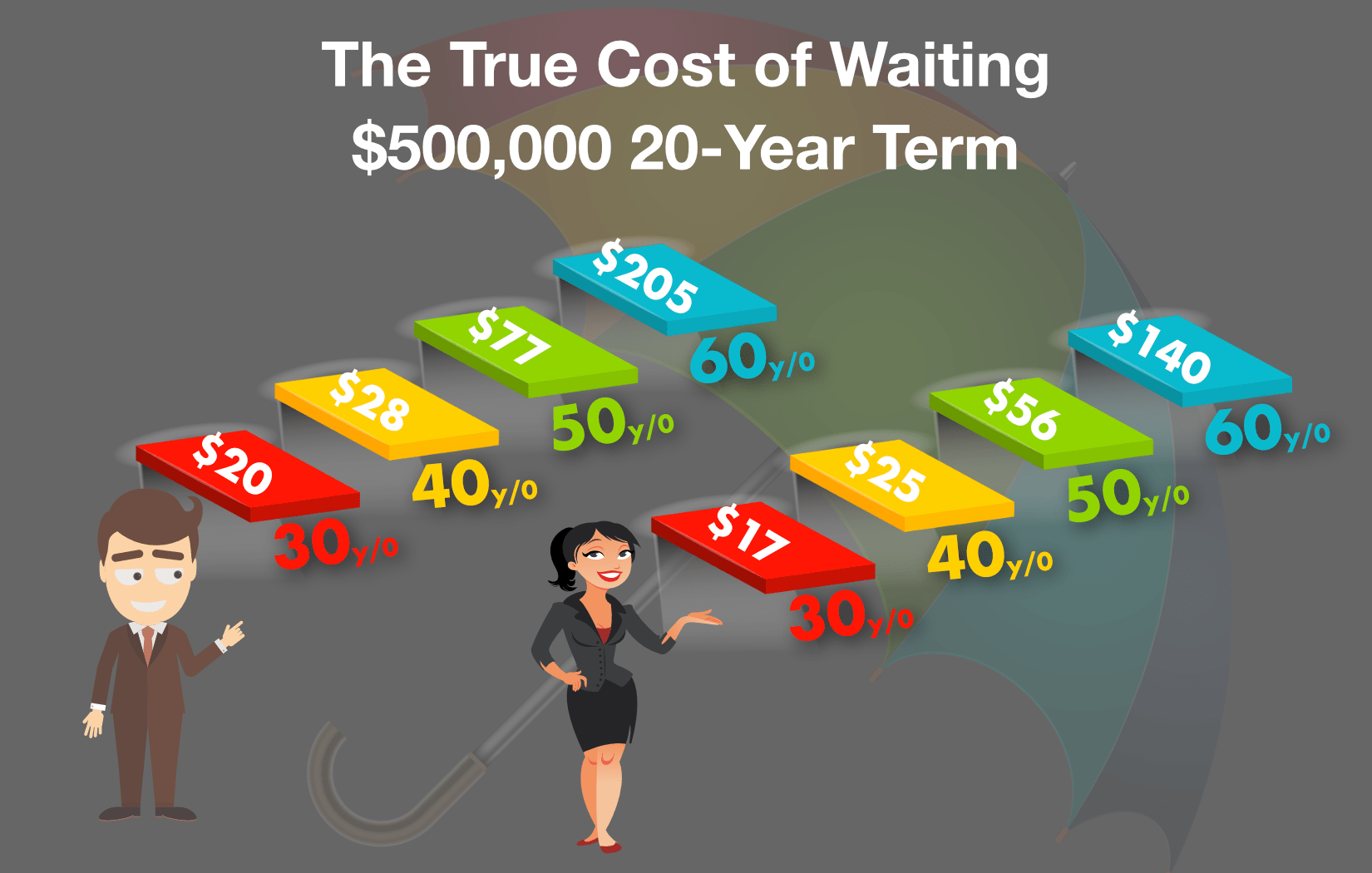

When you're more youthful, term life insurance policy can be a basic means to shield your loved ones. As life adjustments your monetary top priorities can as well, so you may desire to have whole life insurance policy for its life time coverage and extra benefits that you can make use of while you're living.

Approval is assured regardless of your health. The premiums will not increase as soon as they're established, yet they will increase with age, so it's a good concept to secure them in early. Learn more about how a term conversion functions.

1Term life insurance policy supplies temporary security for an essential duration of time and is generally more economical than irreversible life insurance policy. term life insurance policy matures when. 2Term conversion guidelines and restrictions, such as timing, might apply; for instance, there might be a ten-year conversion advantage for some products and a five-year conversion privilege for others

3Rider Insured's Paid-Up Insurance policy Purchase Choice in New York. 4Not offered in every state. There is a price to exercise this cyclist. Products and cyclists are readily available in authorized territories and names and attributes may differ. 5Dividends are not guaranteed. Not all participating policy owners are qualified for rewards. For select bikers, the condition puts on the guaranteed.

Latest Posts

A Long Term Care Rider In A Life Insurance Policy

The Best Funeral Plan

Online Funeral Insurance